8 Common Reasons You Could Be Refused a Mortgage — And How to Fix Them

When applying for a mortgage or remortgage in the UK, even small oversights can cause your application to be declined. Whether you're a first-time buyer, moving home, or remortgaging to get a better deal, lenders look closely at your finances and documentation.

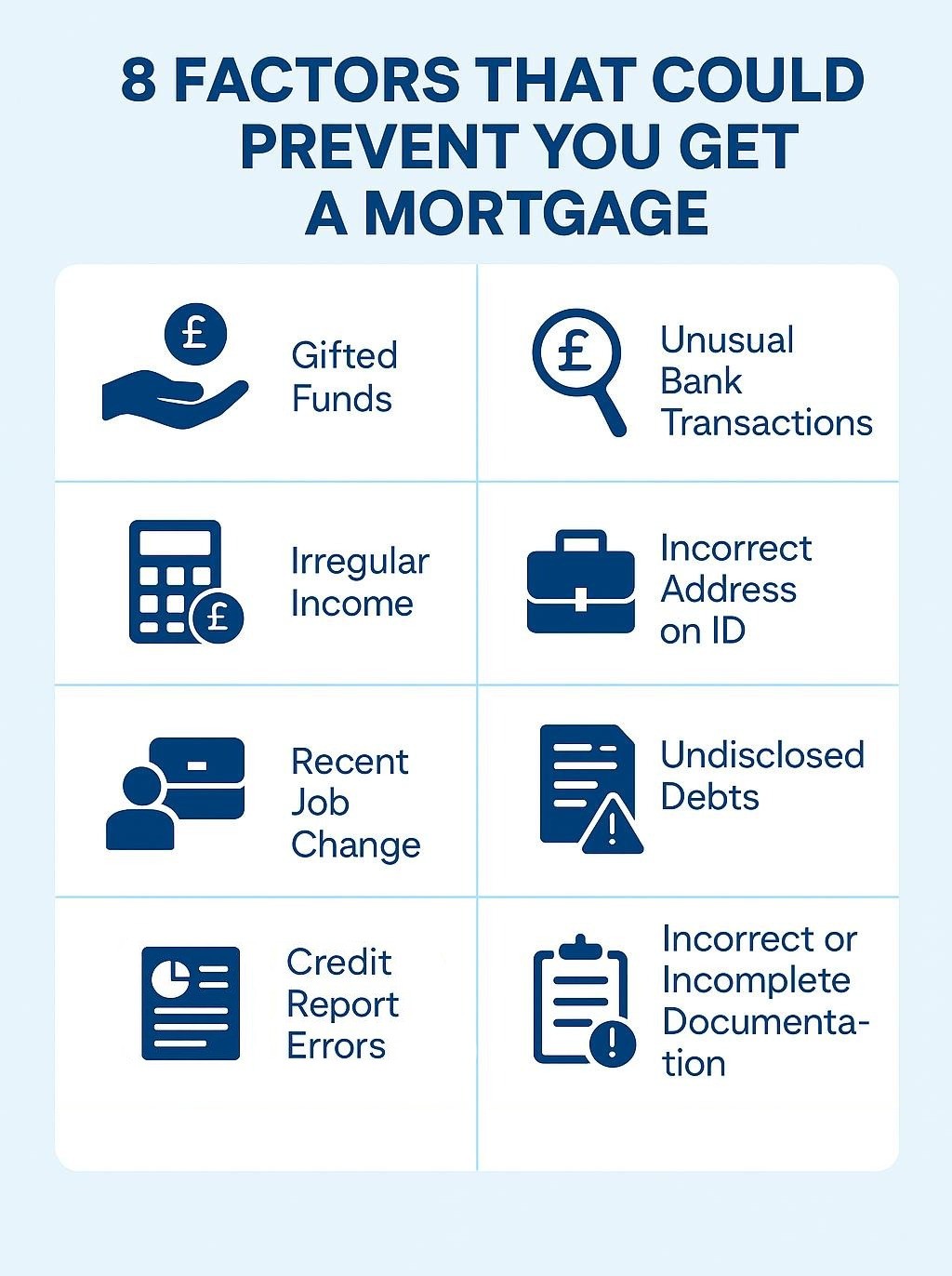

8 Surprising Factors That Could Prevent Mortgage Approval

-

💷 Gifted Funds Without Proper Evidence

Using a gift from a family member for your deposit? Lenders will ask for:

- A gift letter confirming the money is a genuine gift, not a loan

- Proof of the sender's identity and bank statements showing the transfer

Fix: Make sure the funds are traceable and that you have documentation ready before submitting your application.

-

💳 Unusual Bank Transactions

Lenders go through your bank statements line by line. Red flags include:

- Large unexplained deposits or withdrawals

- Frequent gambling transactions

- Irregular spending patterns

Fix: Avoid suspicious transactions for at least 3 months before applying and be ready to explain any large movements of money.

-

📉 Irregular Income or Freelance Work

Self-employed or have multiple income streams? Lenders want to see consistency — not just how much you earn, but how reliably you earn it.

Fix: Submit at least 2–3 years of accounts or SA302s and work with a broker who understands complex income structures.

-

🏠 Incorrect Address on ID

If your current address doesn’t match your driving licence, utility bills, or bank account, your application may get flagged.

Fix: Update all key documents to match your current address before you apply.

-

💼 Recent Job Change

Just switched employers? Some lenders won’t accept applicants still in a probation period or without 3+ months in a new job.

Fix: Wait until your probation ends or apply with a lender that accepts recent job changes. A broker can help match you with the right one.

-

💳 Undisclosed Debts

Leaving out personal loans, credit cards, or Buy Now Pay Later (BNPL) arrangements can result in a flat-out rejection.

Fix: Disclose all financial commitments. Lenders will check your credit file anyway, so it's better to be upfront.

-

📝 Incorrect or Incomplete Documentation

Common documentation issues include:

- Missing payslips

- Unsigned bank statements

- Outdated financial records

Fix: Double-check your documents:

- Are your payslips recent?

- Are your bank statements full and unedited?

- Are all documents dated and signed where needed?

-

📉 Credit Report Errors

From outdated addresses to incorrectly marked defaults, credit file mistakes are shockingly common — and damaging.

Fix: Check your credit reports with Experian, Equifax, and TransUnion before applying. Dispute any inaccuracies and allow time for corrections.

✅ Work with a Mortgage Broker Who Gets It Right First Time

At Remortgage Expert, we understand what lenders look for — and how to avoid these common pitfalls. Whether you're remortgaging or applying for the first time, we help you prepare your application for maximum success.

Ready to get started?

Book a free consultation and let’s make sure your mortgage application goes through smoothly.